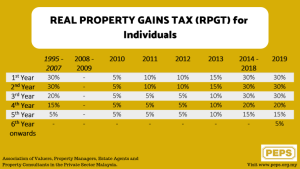

Header Image from BNM Real Property Gains Tax, or RPGT, is a form of tax imposed on the disposal of properties and the rate differs according to the number of years the owner has held on to the property. Stamp duty, on the other hand, is another tax payable upon…